Financial and Managerial Accounting 9th Edition Access Code empowers you with the knowledge and tools to navigate the complexities of financial reporting and decision-making. This comprehensive guide provides a solid foundation in the core concepts, frameworks, and applications of financial and managerial accounting, equipping you to make informed decisions that drive organizational success.

From understanding the accounting cycle and financial statement analysis to mastering cost accounting systems and budgeting techniques, this access code unlocks a wealth of resources that will enhance your understanding of financial management.

Key Concepts and Framework

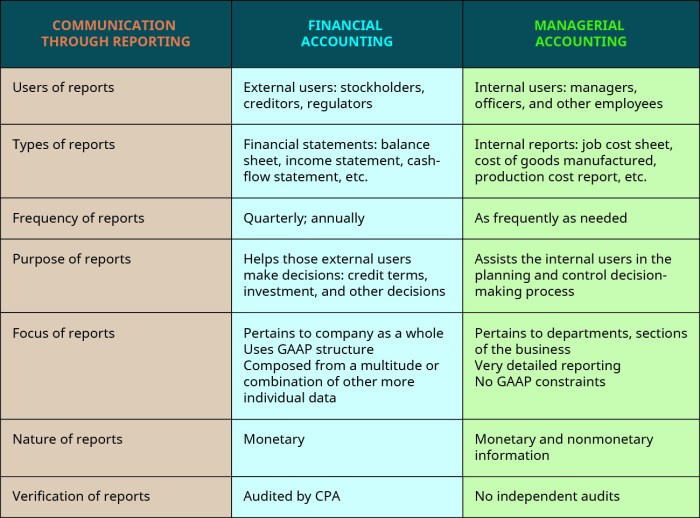

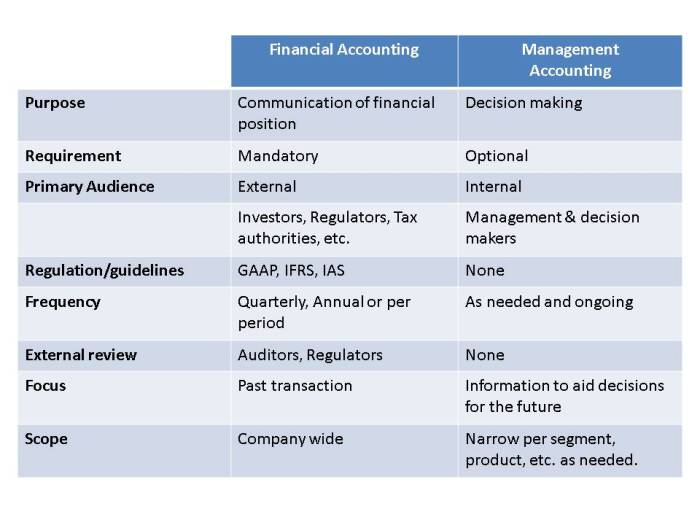

Financial accounting focuses on reporting a company’s financial performance to external stakeholders, such as investors and creditors. Managerial accounting, on the other hand, provides information to internal users, such as managers and employees, to help them make informed decisions.

Types of Financial Statements

- Balance sheet: Provides a snapshot of a company’s financial health at a specific point in time.

- Income statement: Shows a company’s revenues, expenses, and profits over a period of time.

- Statement of cash flows: Reports on the sources and uses of cash over a period of time.

Role of Accounting Principles and Standards

Accounting principles and standards provide a consistent framework for financial reporting. This ensures that financial statements are accurate, reliable, and comparable across companies.

Financial Accounting: Financial And Managerial Accounting 9th Edition Access Code

Accounting Cycle

The accounting cycle is a series of steps that companies follow to record and report their financial transactions.

Recording and Classifying Transactions

Transactions are recorded in a journal and then classified into accounts. The most common types of accounts are assets, liabilities, equity, revenues, and expenses.

Depreciation Methods

Depreciation is a process of allocating the cost of a long-term asset over its useful life. There are several different depreciation methods, each with its own impact on financial statements.

Managerial Accounting

Role in Decision-Making

Managerial accounting provides information to help managers make informed decisions about pricing, production, marketing, and other aspects of the business.

Cost Accounting Systems, Financial and managerial accounting 9th edition access code

Cost accounting systems track and analyze the costs of a company’s products or services.

Budgeting and Variance Analysis

Budgeting is the process of planning a company’s financial activities for a future period. Variance analysis compares actual results to budgeted results and helps managers identify areas where improvements can be made.

Accounting for Special Transactions

Long-Term Assets

Long-term assets are assets that have a useful life of more than one year. The accounting treatment of long-term assets depends on the type of asset.

Inventory

Inventory is a company’s stock of goods that are available for sale. The accounting treatment of inventory depends on the type of inventory and the company’s inventory costing method.

Mergers and Acquisitions

Mergers and acquisitions are transactions that combine two or more companies. The accounting treatment of mergers and acquisitions depends on the type of transaction.

Financial Statement Analysis

Financial Ratios

Financial ratios are used to analyze a company’s financial performance. There are many different types of financial ratios, each with its own purpose.

Using Financial Statement Analysis

Financial statement analysis can be used to identify trends, make informed decisions, and evaluate a company’s financial health.

Limitations of Financial Statement Analysis

Financial statement analysis has some limitations. For example, financial statements are based on historical data and may not reflect future performance.

Access Code

How to Redeem the Access Code

To redeem your access code, follow these steps:

- Go to the publisher’s website.

- Enter your access code.

- Follow the instructions on the website.

Benefits of Using the Access Code

The access code provides access to a variety of resources, including:

- Online homework assignments

- Practice exams

- Interactive simulations

Commonly Asked Questions

How do I redeem the access code?

Follow the instructions provided with the access code to redeem it online.

What benefits do I get with the access code?

The access code provides access to online resources such as interactive simulations, practice exercises, and additional study materials.

What resources are available through the access code?

The access code unlocks a range of resources, including digital textbooks, videos, case studies, and assessment tools.